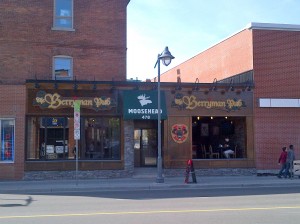

What do the magical wardrobe of Narnia and Ottawa’s Centretown neighbourhood have in common? They both provide the framework for dreams to flourish. To enter all of the wonders of Narnia one merely needs to step into the magical wardrobe, likewise in order to take advantage of all of the wonders of Centretown one simply needs to step out their front door.

Centretown has a vast amount of wonders to experience, from international cuisine to boutique shops to entertainment facilities. As a result of this many students seek out this area in search of dwellings. I have often heard that finding a home for second year is one of the most difficult parts of first year, and I can attest to this. With thousands of students leaving residence each year, it is becoming increasingly difficult for one to rent a home.

Renters vs. Owners

According to a 2006 census done by the city of Ottawa, 27,085 people in the heart of the city rent homes. This is compared to the 12,220 people living in the area who own homes [1]. This shows that more than double the amount of people rent rather than buy. A considerable number of renters are students, while a very miniscule number of owners are. Possibly due to the fact that very few students think about buying a home while still in school.

Rent or Own: A Numbers Game

After examining a number of rental listings in the area it appeared that a rough average price of $500 per month was prevalent. Now lets look at a house of five students, at that price the total rent for the house would be $2500 per month, $6000 each per year and $30,000 in total. If they chose to live in the house for three years those numbers would jump to $18,000 each and $90,000 in total. Consider that the lowest price for a house in the area was $287,000, so let’s say these students could find a house for around $300,000. To simplify things and to lower the down payment, it may be required to get a guarantor. A guarantor is an individual who personally guaranties that mortgage payments will be paid if the applicant fail to do so. With a guarantor secured a down payment of 10% can be put down on the house. On the house in this example that would be $30,000. If that were to be split between the five students it would be $6000 each. Depending how much the students worked during the summer a small student loan may be required. With a mortgage of $270,000, a three year fixed interest rate of 4.05% and an amortization period of 30 years the monthly payments would be $1291.55 per month [2]. That works out to $258.31 per person. Over three years that would total $15,299 each, including the down payments. That’s a savings of nearly $3000.

Everyone Wins

After everyone has finished school, if they all decide to go their separate ways the house could be sold to re-accumulate their investment. The empty rooms could also be rented instead at the average price of $500 garnering each individual $241.69 extra per month.

This is just one possible alternative to renting for students looking for a house in Centretown.

Would you consider buying a home as opposed to renting while still in, or right out of university?

[1] http://www.ottawa.ca/residents/statistics/census/urban_subareas/subarea2_en.html

[2] http://www.tdcanadatrust.com/docs/mortCalc/MortgageCalculator.jsp